On the cryptocurrency arena, the whole past and almost half of this year saw one continuous “winter” after Bitcoin's price dropped to $ 3,122 in December 2018 after a peak of $ 20,000 a year earlier. In the following months, the price rose again, reaching almost $ 14,000 in July, but has since halved. Unfortunately, the forecasts of homegrown experts that the price will rise again to the old record, or even higher - up to $ 50,000, $ 100,000, or even $ 1,000,000 - did not come true. It is difficult to say whether this is due to the disappointing launch of Bakkt, the ban on the first ETF on Bitcoin, or the lack of mass interest from institutional institutions.

In severe winter, parasites always die, which can be said about the cryptocurrency scene. More than 80% of projects that conducted initial coin offerings (ICOs) turned out to be obvious scams, and a study of the most popular crypto-rating site CoinMarketCap shows that out of the 2000 largest crypto projects, more than a quarter more than a year did not publish updates on GitHub, and a third did not do this over the past 5 years.

“Winter is the time of year when we need to endure difficulties, endure, and also the price we pay for the bright and beautiful spring coming after it.” - Eric Voorhees

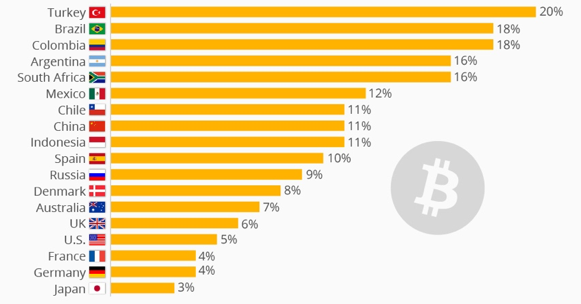

After a harsh winter, spring always arrives, and projects that survived the winter are showing remarkable progress, so there are good prospects for 2020. According to Kaspersky Lab, almost 20% of the global population bought cryptocurrency. And according to Deloitte, companies are also more and more positive about their use.

The cryptocurrency scene is one of the few known environments that are changing so quickly now. Every day, new technological developments and the actions of governments significantly affect the price levels, use and further development of cryptocurrencies. Anyway, in 2020 a number of important events are expected that will definitely have a strong impact on cryptocurrencies.

1) Halving of Bitcoin

If you analyze cryptocurrency news in recent months, then most often they talk about one upcoming event: halving or the so-called “halving” of Bitcoin, which is scheduled for approximately May 2020. Then the remuneration of miners in the Bitcoin network will be halved, which is always historically led to a price increase of several hundred percent due, inter alia, to a reduction in the available number of bitcoins. However, opinions were divided, as some experts note that the price increase in 2019 (from $ 3 thousand to $ 13 thousand) was caused by the “halving effect”. Some even believe that reducing rewards will negatively affect the price, because many small miners will no longer be interested in turning on their computers to support the Bitcoin blockchain. In previous halves, the price always increased at the beginning of the month, so in the first quarter we will immediately see whether it will be the long-awaited catalyst that will increase the cost of not only bitcoin, but also closely related altcoins, which always grow exponentially. Will we see a new historical high? Or will it be the greatest deception of the expectations of cryptocurrency owners in the last two years? We will find out in the first months of 2020!

2) Libra from Facebook

Recently, at the annual European Commission blockchain event in Malaga, I heard about Facebook’s Libra plans for 2020. The company has recently met with a strong backlash on its latest project from governments, so it’s not even known whether the project will even be launched. In Europe, Germany, France and Italy are developing measures to ban the project, and there is no certainty about the launch in the USA, although CEO Zuckerberg recently announced that the launch will take place only if the regulators fully agree. He also warned investors that the project might not be launched at all. Other top managers of the social network, as well as a number of important shareholders, criticized the project from the very beginning. PayPal, Visa and MasterCard refused to participate, possibly under pressure from US regulators.

Given the scandals surrounding Facebook, the question arises as to whether we want to trust the social network with something as fragile as our financial data (according to a study by the Netherlands Bank, the most sensitive confidential consumer data). On the other hand, 1.7 billion (!) People in the world still do not have bank accounts, and 1 billion of them have mobile phones. According to the World Bank, now they pay high commissions (on average 7%) for the transfer and receipt of money through the mediation of third parties. The money saved on commissions could make a significant contribution to the economic growth of countries and the achievement of the UN sustainable development goals. McKinsey even estimated that over the next 10 years this could add $ 3.7 trillion to developing countries' GDP.

Central banks point to two main concerns:

In severe winter, parasites always die, which can be said about the cryptocurrency scene. More than 80% of projects that conducted initial coin offerings (ICOs) turned out to be obvious scams, and a study of the most popular crypto-rating site CoinMarketCap shows that out of the 2000 largest crypto projects, more than a quarter more than a year did not publish updates on GitHub, and a third did not do this over the past 5 years.

“Winter is the time of year when we need to endure difficulties, endure, and also the price we pay for the bright and beautiful spring coming after it.” - Eric Voorhees

After a harsh winter, spring always arrives, and projects that survived the winter are showing remarkable progress, so there are good prospects for 2020. According to Kaspersky Lab, almost 20% of the global population bought cryptocurrency. And according to Deloitte, companies are also more and more positive about their use.

The cryptocurrency scene is one of the few known environments that are changing so quickly now. Every day, new technological developments and the actions of governments significantly affect the price levels, use and further development of cryptocurrencies. Anyway, in 2020 a number of important events are expected that will definitely have a strong impact on cryptocurrencies.

1) Halving of Bitcoin

2) Libra from Facebook

Recently, at the annual European Commission blockchain event in Malaga, I heard about Facebook’s Libra plans for 2020. The company has recently met with a strong backlash on its latest project from governments, so it’s not even known whether the project will even be launched. In Europe, Germany, France and Italy are developing measures to ban the project, and there is no certainty about the launch in the USA, although CEO Zuckerberg recently announced that the launch will take place only if the regulators fully agree. He also warned investors that the project might not be launched at all. Other top managers of the social network, as well as a number of important shareholders, criticized the project from the very beginning. PayPal, Visa and MasterCard refused to participate, possibly under pressure from US regulators.

Given the scandals surrounding Facebook, the question arises as to whether we want to trust the social network with something as fragile as our financial data (according to a study by the Netherlands Bank, the most sensitive confidential consumer data). On the other hand, 1.7 billion (!) People in the world still do not have bank accounts, and 1 billion of them have mobile phones. According to the World Bank, now they pay high commissions (on average 7%) for the transfer and receipt of money through the mediation of third parties. The money saved on commissions could make a significant contribution to the economic growth of countries and the achievement of the UN sustainable development goals. McKinsey even estimated that over the next 10 years this could add $ 3.7 trillion to developing countries' GDP.

Central banks point to two main concerns:

- financial system stability - what will happen if Libra becomes so large that it will affect the monetary policy of banks;

- how the company will counteract money laundering and identify all network participants, for example, to impede the financing of terrorism. Both issues have not yet been clarified.

So next year will be interesting, and not just because of Libra. Other large companies, such as Walmart, are also working on their own digital currencies, and various governments are increasingly considering this possibility, as in the case of the European Union and China. There are also companies behind governments that indicate that the monetary system should remain in the hands of the latter, as Apple CEO Tim Cook recently hinted at. Be that as it may, the business case remains very interesting. Various studies have shown that consumers spend a lot more on digital money than cash, which is known as the "effect of the game at the expense of the establishment." But even according to the Libra developers, it will take many years to adopt such a system.

3) Big money

It is believed that the launch of Bakkt was one of the main deceptions of expectations on the cryptocurrency scene in 2019.The platform was supposed to allow, on the one hand, the effective purchase, sale, issue and storage of cryptocurrencies, and on the other hand, the use of large players such as Starbucks (with 30,000 branches), previously the majority of digital payments made through Apple Pay (in the USA). It was supposed that this would cause huge demand for bitcoin, which, of course, should have a positive impact on the price. Unfortunately, the enthusiasm around the platform disappointed, and Bitcoin's price fell 19%.

Since its parent company owns the largest stock exchanges such as New York and collaborates with reputable names such as Microsoft and BCG, the platform should have mainly inspired institutional investors, such as pension funds, to invest large amounts in cryptocurrency . This was not the case before, as the infrastructure simply did not exist and the cost of the coins was too volatile. The Bakkt platform was supposed to remove both obstacles.

It's no secret that large investors are eager to enter the cryptocurrency market. On the sidelines of a number of large Dutch banks they say that bankers advise wealthy clients to invest 5-10% in cryptocurrency in 2020, and many family office managers (managing assets of very wealthy families) work in the same direction. Cryptocurrency companies, such as Coinbase, indicate that they receive hundreds of millions of dollars in futures for storage or trading futures from institutional investors on a weekly basis. The great thing about the blockchain is that everything is transparent, including transactions and amounts on digital wallets. A recent analysis of Bitcoin wallets showed a very strong increase in the number of wallets with large amounts.

Since only 21 million bitcoins can be created and 4 million lost, their rarity is growing, which, of course, is good for the price.

Visible and invisible big money is already entering the market, and I wonder what effect this will have in 2020 on the prices of various cryptocurrencies and, of course, on further development as a whole.

4) Further development of projects

Shrews live an average of a year and a half, so these are the shortest living mammals on Earth. In this regard, they resemble blockchain projects whose average life expectancy is 1.12 years, as a Chinese study of 80,000 projects showed.

Due to the crazy increase in the price of bitcoin, many who want to get rich look for other cryptocurrencies that have the potential to go to the moon (which on cryptocurrency slang means an increase in prices by hundreds of percent). Due to the short life span of most projects, few have become very wealthy due to the right investment, while the large masses simply lost a lot of money by buying or selling too late. In the Netherlands alone, half a million consumers invested about a billion euros in cryptocurrencies, but most of them bought at the top of the market and suffered losses.

In the search for the “new Apple” it is especially important to thoroughly study the projects according to various criteria. You will not just send money to the company when you are not even sure where it is, when its team does not have the necessary knowledge to develop the declared project, and when there is little information about it on the Internet? In the midst of insanity, at the end of 2017, many at random invested money in projects, not finding out all the questions and leaving billions of euros in the pockets of fraudsters who created fake projects, or just a small number of people who sold their assets on time to the majority whose investments subsequently quickly fell in value .

Many authorities in the world of cryptocurrencies continue to call Bitcoin the only worthwhile project and expect that all other cryptocurrencies will soon take their place in the “cryptocurrency cemetery”. There are several other projects that already have a large number of users, have published a number of significant updates and are going to offer great developments in 2020.

In addition to Bitcoin, Ethereum is often referred to as “Microsoft cryptocurrencies,” but it has faced serious competition in the face of, among others, EOS and TRON. If, for example, you look at the number of decentralized applications (dApp) on DappRadar, you can see that of the 50 leading dApps, only three work on the Ethereum network, and the rest on the networks of the two main competitors. Ethereum is a project that is highly respected in the cryptocurrency community, as it took an important step forward in the development of blockchain technology, not only facilitating payments, but also introducing smart contracts and dApp. In 2020, an important update of its network (2.0) is expected in the form of the Serenity program, where a new and much more energy-efficient consensus method for confirming transactions - “proof of ownership” will be introduced, as well as various network scaling solutions, such as sharding , Plasma and Raiden. Given the fast-growing trend around dApp and the possible approval of regulated futures, this can have a very positive effect on the price of cryptocurrency.

Other projects that are taking important steps are Ripple, which has already connected 200 banks to its network and can supplant SWIFT (the organization that controls the global financial system now), as well as VeChain, BAT, EOS, IOTA and TRON.

5) Regulation

The governments of different countries are actively working to regulate the rapid growth of cryptocurrencies and companies in this industry. If this does not impede innovation, then we are in favor, since it not only reduces the likelihood of using cryptocurrencies in criminal activities, such as money laundering, but also gives greater confidence to large investors, allowing them to enter the market faster.

One of the main tasks of governments is to protect their citizens. After many scandals surrounding cryptocurrencies in recent years, when consumers lost a lot of money by investing in fake and / or mysteriously bankrupt projects, as in the case of QuadrigaCX, the Dutch government takes this task very seriously. It even wants to introduce relevant laws and regulation faster than other European countries. In January, the AMLD5 directive will come into force, according to which cryptocurrency exchanges and trustees (wallets) will have to register with the Netherlands Bank, receive an assessment of the compliance of their directors and shareholders and demonstrate that their business processes comply with the requirements of combating money laundering and financing of terrorism.

According to Dutch Minister of Finance Wopke Hukstre, the main goal is the fight against money laundering. Companies to which these requirements will be applied actively seek to adapt to them, and most of them already comply with them.

Given the above-mentioned expectations for 2020 in the field of cryptocurrencies, it is very interesting how events will develop, what will actually happen and how this will affect the industry. According to many experts, Bitcoin will either continue to move forward or crash. There is a high probability that this will mainly be a year of rapid growth in maturity and further technological development of the industry.