Since 2011, the mainstream media, bank executives, economists and other skeptics happily declare Bitcoin's demise after each serious correction from historical highs.

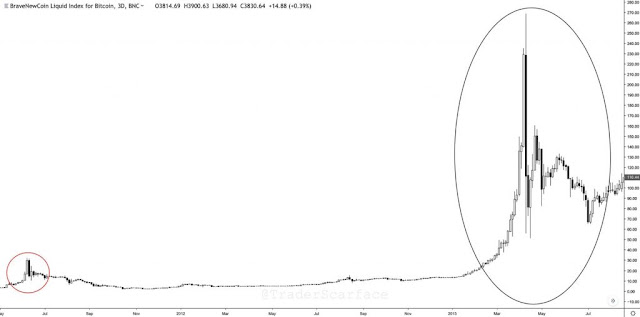

Over the past ten years, Bitcoin has undergone five 85 percent corrections, including the recent 14-month bear market. However, the dominant cryptocurrency was able to survive each of them, reaching new heights after each major fall, and thus challenges the critics.

Industry experts and influential investors are confident that the year 2019 will not be different for Bitcoin, especially given the unexpected entry of institutional investors and financial institutions into the cryptocurrency sector.

WHY BITKOIN IN A STRONG PLACE TODAY THAN IN 2017

February 1, Blocktower Investment Director Ari Paul said he was too optimistic about institutional investors' commitment to the cryptocurrency industry. At the same time, Paul says he expects institutional investors to appear on the cryptocurrency market closer to the third quarter of 2019. Direct speech:

“I was too optimistic about the pace of institutional adoption in the past. This is going, but I cannot estimate in which quarter (either this year or in 2022) we will see a big surge. I can make a modest assumption that this will happen in the 3rd quarter of 2019. ”

However, two weeks after the publication of this statement, Paul Anthony Pompiano from Morgan Creek announced that two US government pension funds had invested in a cryptocurrency fund. Thus, the institutional implementation of cryptocurrency arrived faster than the expectations of existing investors in the sector.

According to CCN, the Singapore National Wealth Fund GIC invested in Coinbase at the end of 2018, which could spur investor confidence in the long-term growth of the cryptocurrency sector.

The concern of skeptics about the state of Bitcoin after a serious correction has always been associated with a lack of liquidity and activity in the cryptocurrency market. As of March 2, the daily volume of the exchange-based cryptocurrency market is estimated at about $ 24 billion, and the over-the-counter (OTC) market for digital assets is said to be at least twice as large as the size of the exchange-based market.

Given the fact that Bitcoin is gaining momentum, and this can be determined by the fact that for the first time in the last eight months we saw a green “monthly” candle. Already, analysts predict cryptocurrency will begin a steady recovery in March or April.

PREDICTING THE NEAR MOTION OF CRYPTO

In the short term, traders expect BTC to maintain its low volatility in a narrow price range. But if the flagship cryptocurrency can overcome the key resistance levels - $ 4,000 and $ 4,200, which were previously tried to break through, it can enter the accumulation phase.

Analyst David Puell said that $ 4,200 is an important level for Bitcoin, as it represents the average acquisition price on the market.

The price movement in the cryptocurrency market will largely depend on whether Bitcoin can overcome the $ 4,200 mark and avoid falling below $ 3,100.

Several tokens and low market capitalization cryptocurrencies, such as Binance Coin and Basic Attention Token, have already shown a relatively large increase in recent weeks against BTC and the US dollar. Therefore, it is only a matter of time when large-cap assets follow suit.